Life & Voluntary Life

Life and accidental death and dismemberment (AD&D) insurance provides financial protection for those who depend on you for financial support. Upon your death, your designated beneficiary will receive the life benefit. If you die as the result of an accident, your beneficiary will receive both the life and AD&D benefits.

SPOONER-PAID LIFE/AD&D COVERAGE

This benefit is provided at NO COST to you through UNUM.

BASIC LIFE AND AD&D INSURANCE

Spooner provides employees who work 20 or

more hours/week with basic life and AD&D

insurance at no cost.

-

Employee life insurance benefit:$30,000*

-

Employee AD&D insurance benefit: $30,000*

*Age-reduction rules apply. See plan details.

DESIGNATE A BENEFICIARY

In the event of your death, UNUM would pay your Life and/or AD&D policy to your beneficiaries. Designate your beneficiary for your Spooner-paid Life and AD&D insurance, as well as any additional life insurance. You may change this designation at any time. You are automatically the beneficiary on your Spouse and/or Child Life policy.

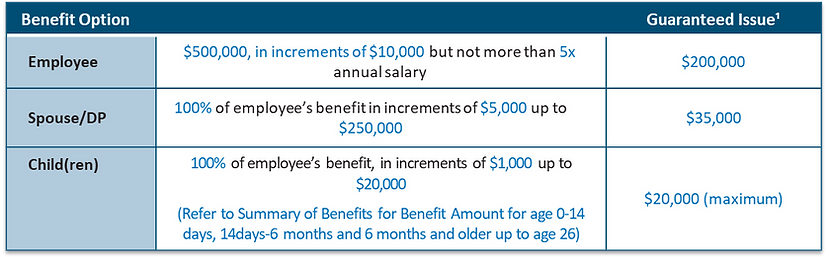

EVIDENCE OF INSURABILITY

If you purchase Life and AD&D insurance for yourself or your spouse and/or children when you are first eligible to enroll, you may purchase up to the guarantee issue amounts without completing a statement of health (Evidence of Insurability). If you do not enroll when first eligible, and choose to enroll during a future open enrollment period, you will be required to submit Evidence of Insurability for any amount of coverage. Coverage will not take effect until approved by UNUM.

ADDITIONAL LIFE AND AD&D INSURANCE

Depending on your personal situation, The Spooner-paid life and AD&D insurance might not be enough coverage for your needs. Spooner provides you the option to purchase additional life and AD&D insurance at group rates through UNUM. You may also purchase voluntary coverage for your spouse and eligible children.

VOLUNTARY LIFE/AD&D COVERAGE

Depending on your personal situation, basic life and AD&D insurance might not be enough coverage for your needs. You have the option to purchase voluntary life and AD&D insurance at group rates through UNUM. You may also purchase voluntary coverage for your spouse and eligible children.

pooner-paid Life and AD&D insurance, as well as