Dependent Care Flexible Spending Account (DCFSA)

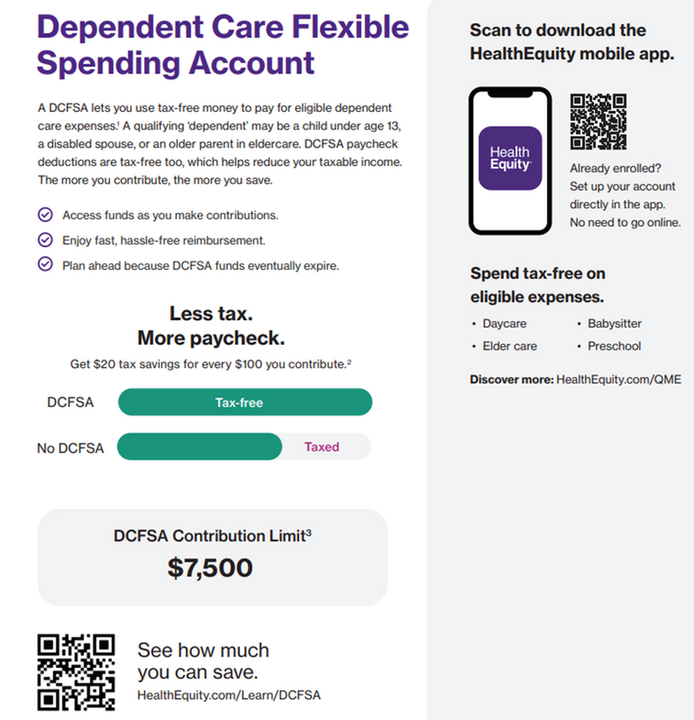

Spooner offers Dependent Care flexible spending account (FSA) through HealthEquity. The money that you put into an FSA is collected from your paycheck before taxes are withheld, which means you don’t pay taxes on those dollars.

See how much you can save

*DCFSAs are never taxed at a federal income tax level when used appropriately for eligible dependent care expenses. Also, most states recognize DCFSA funds as tax deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules. **The example is for illustrative purposes only. Estimated savings are based on a maximum annual contribution and an assumed combined federal and state income tax bracket of 20%. Actual savings will depend on your contribution amount and taxable income and tax status. ***Contribution limit is accurate as of 10/22/2024. Each fall the IRS updates the DCFSA contribution limits. For the latest information, please visit: HealthEquity.com/Learn |HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions. Copyright ©HealthEquity, Inc. All rights reserved. OE_DCFSA_ Standard Flyer 10.29.2024